Private funds

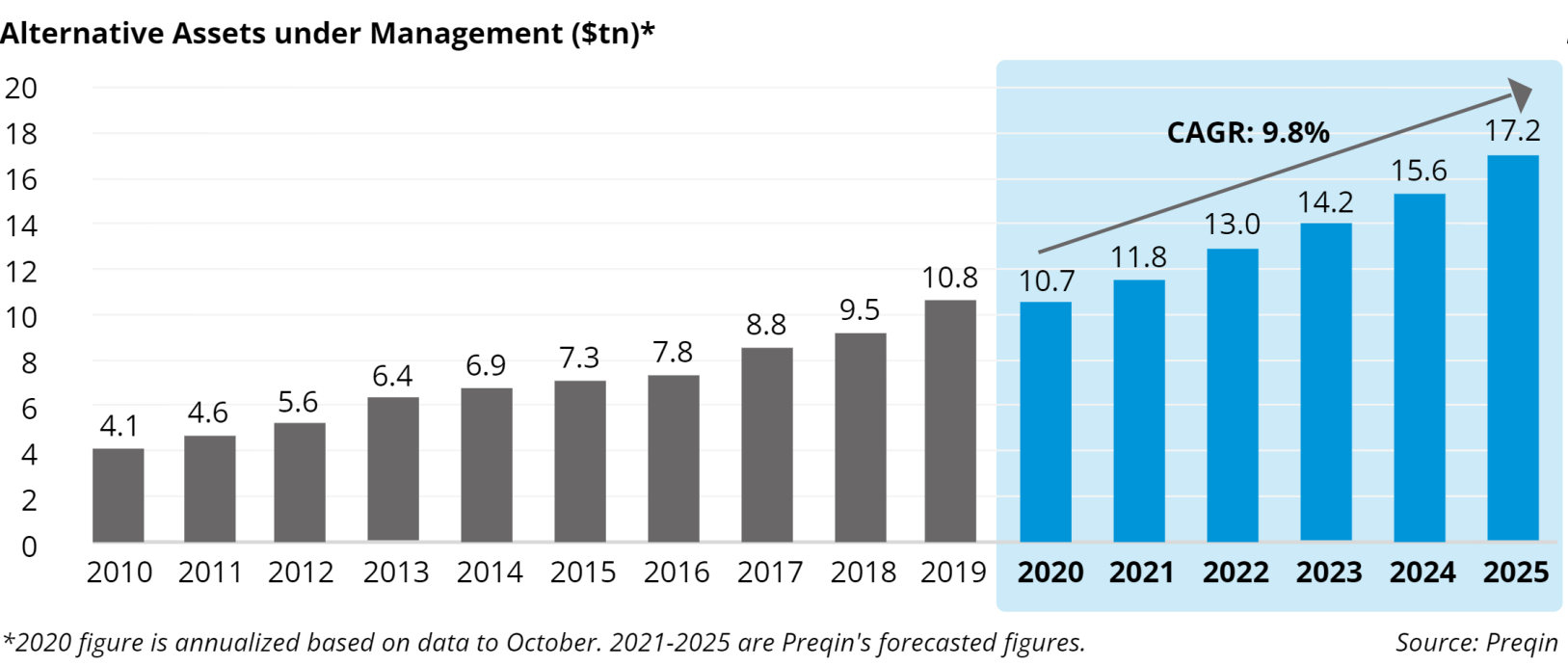

Private funds are one of the most desirable asset classes. Private funds are more attractive to investors as they are significantly less volatile than public markets. They also have greater risk adjusted returns, outperform in recessions, and have predefined exposures. However, a large drawback of private funds is that there isn’t any standard of systematically evaluating and investing into them, which creates high costs and barriers of entry. This is due to a lack of access and limited transparency. As you can see below, the alternative assets class is consistently growing, and is projected to grow more in the coming years.

Lower volatility than other investment choices

Public equities experienced a volatile start to 2022, with investors showing high levels of uncertainty amid rising inflation, higher interest rates, and geopolitical instability. However, volatility can be seen as an opportunity for investors. Placing investments in private asset classes such as hedge funds or private equity can reduce investor’s temptation to take on losses that would otherwise be avoided with patience. Managed fund investment strategies often see downside protections and improved returns.

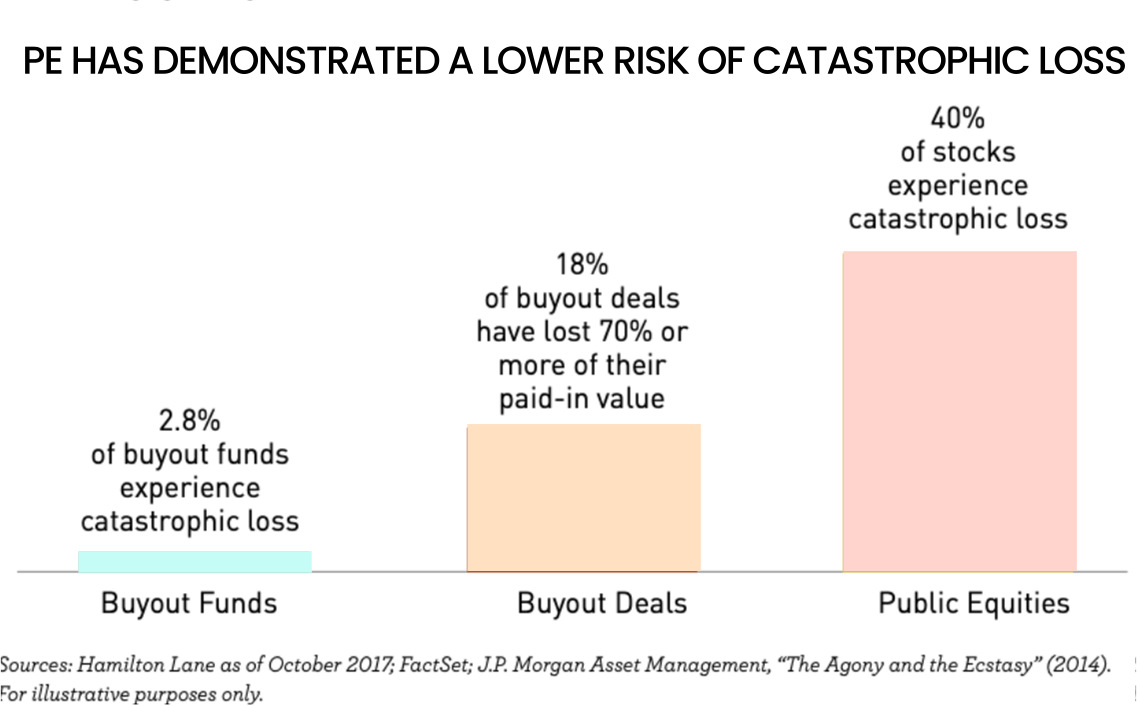

Lower chance of catastrophic loss

In addition to the volatility being much lower, private equity represents a lower risk of catastrophic loss during recessions. In an analysis of the Russell 3000 Index performed by J.P. Morgan, it was observed that 40% of public equities endured catastrophic loss during recessions (defined as 70% loss in investment). Meanwhile, only 18% of buyout deals endured catastrophic losses to their paid-in value, and only 2.8% of buyout funds experienced catastrophic losses. This study concluded that public stocks are 13 times riskier than private equity funds.

Due to the illiquid nature of private equity, this offers protection to investors during periods of economic downturn. Panic selling in PE is not as common. In fact, the multi-year holding period of PE funds is advantageous to the managers, giving them the opportunity to wait for better market conditions.

Private Funds vs. Public Markets

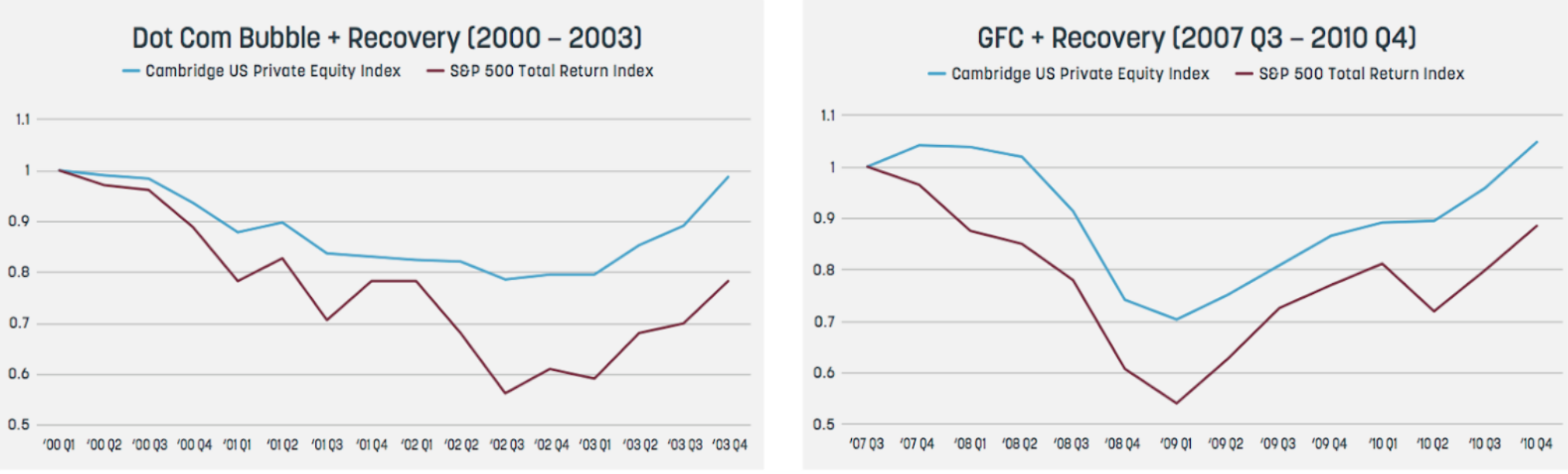

Historically, it has been observed that private equity funds outperform public equities during recessions. As seen during the dot-com bubble (early 2000s) and the GFC (2007-2009) private equities had a quicker recovery and less significant draw downs.

During times of economic downturns, private funds can offer some protection and resilience to the swings of public markets. With the 2022’s volatile market conditions, investors are finding significant value in private funds and active strategies.

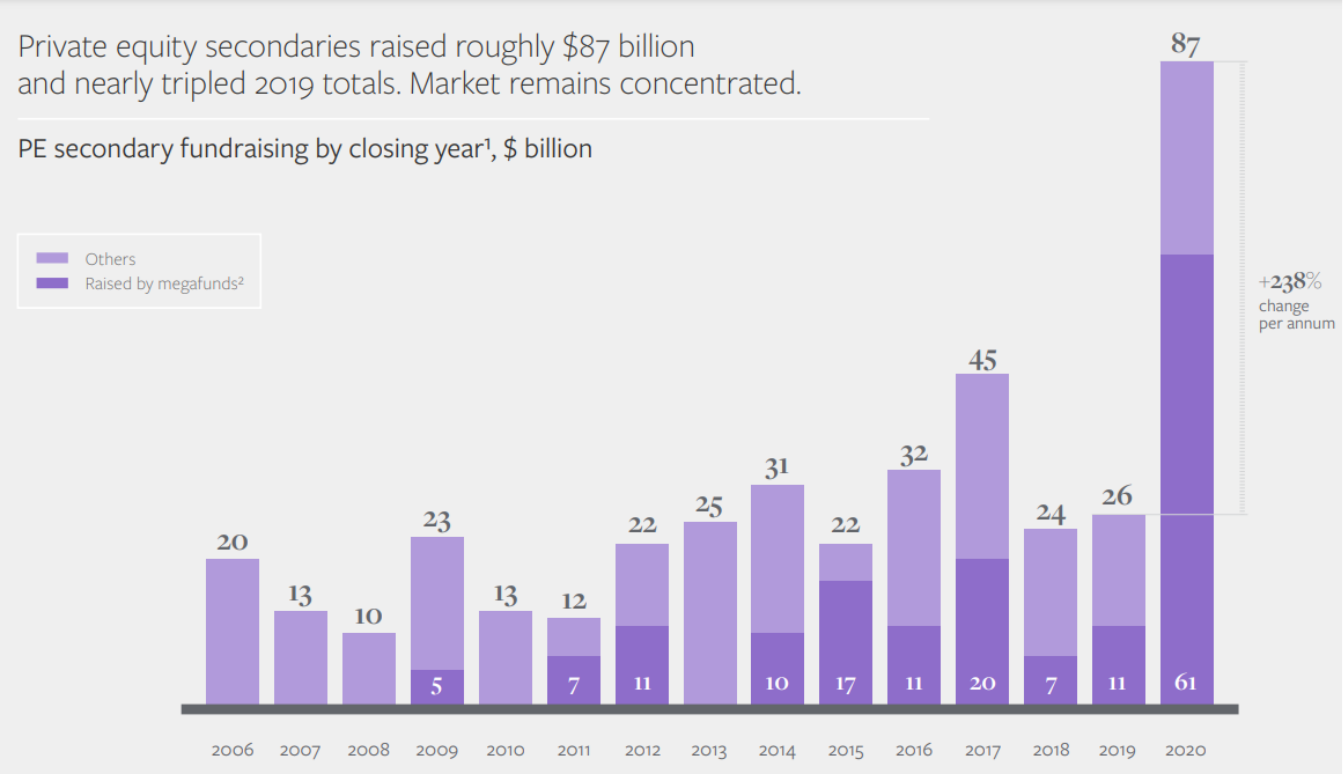

Demand

The attractiveness of private funds continues to increase as investor demand grows. The resiliency of the sector, historical out performance during downturns, and changing allocations continues to be forces driving new inflows.

Access

Traditionally, access to private funds has been limited. Typically, private funds are accessed through referrals, networking events, or databases that demand a high price for out of date information. This is just another barrier that has kept some investors out of private funds.