Velvet for Investment Advisors

RIAs in Alternatives

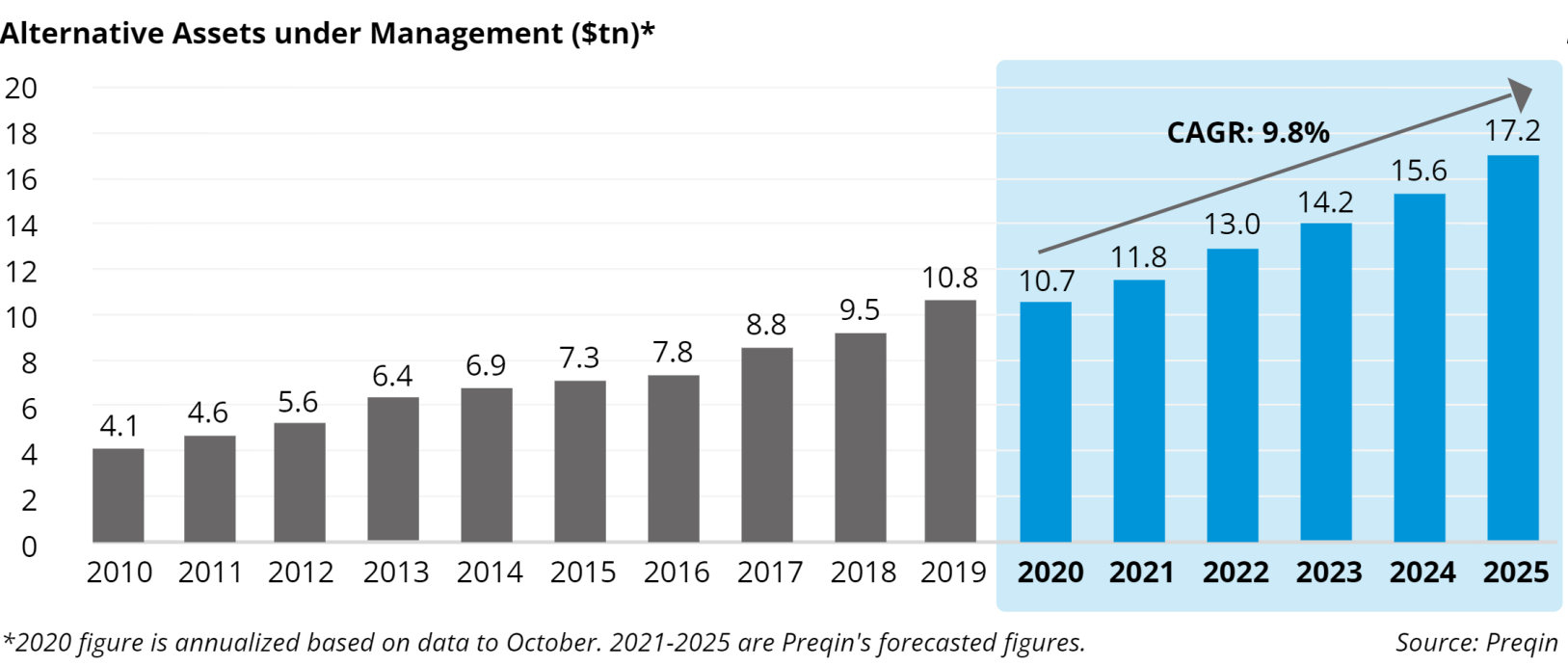

Alternative investments' popularity has been growing rapidly, and it isn’t projected to stop any time soon. Previously, RIAs have struggled to access alternative investments. With current technology, alternative investments are more accessible than ever — meaning RIAs can now compete against the brokerages at big banks.

Private vs. Public Markets

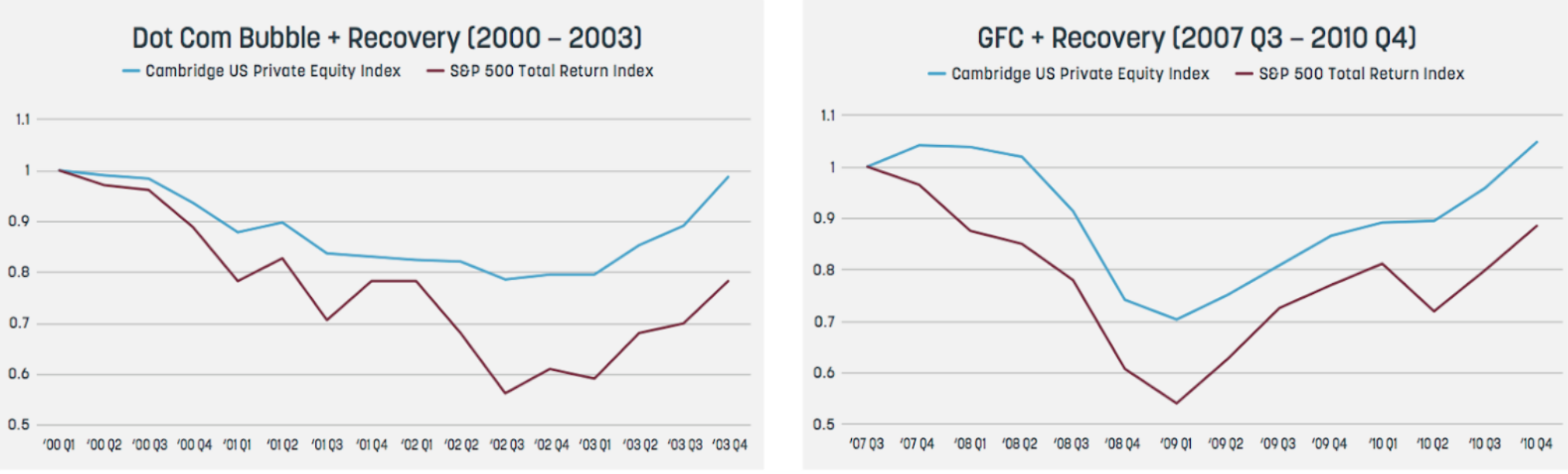

During times of economic downturns, private funds can offer some protection and resilience to the swings in public markets. One reason being is that private funds are not as at risk to the same interest rate volatility as public markets.

Historically, it has been observed that private equity funds outperform public equities during recessions. As seen during the dot-com bubble (early 2000s) and the GFC (2007-2009), shown in the Neuberger Berman Group Study, we saw that private equities had a quicker recovery and less significant draw downs.

RIAs in Digital Asset Funds

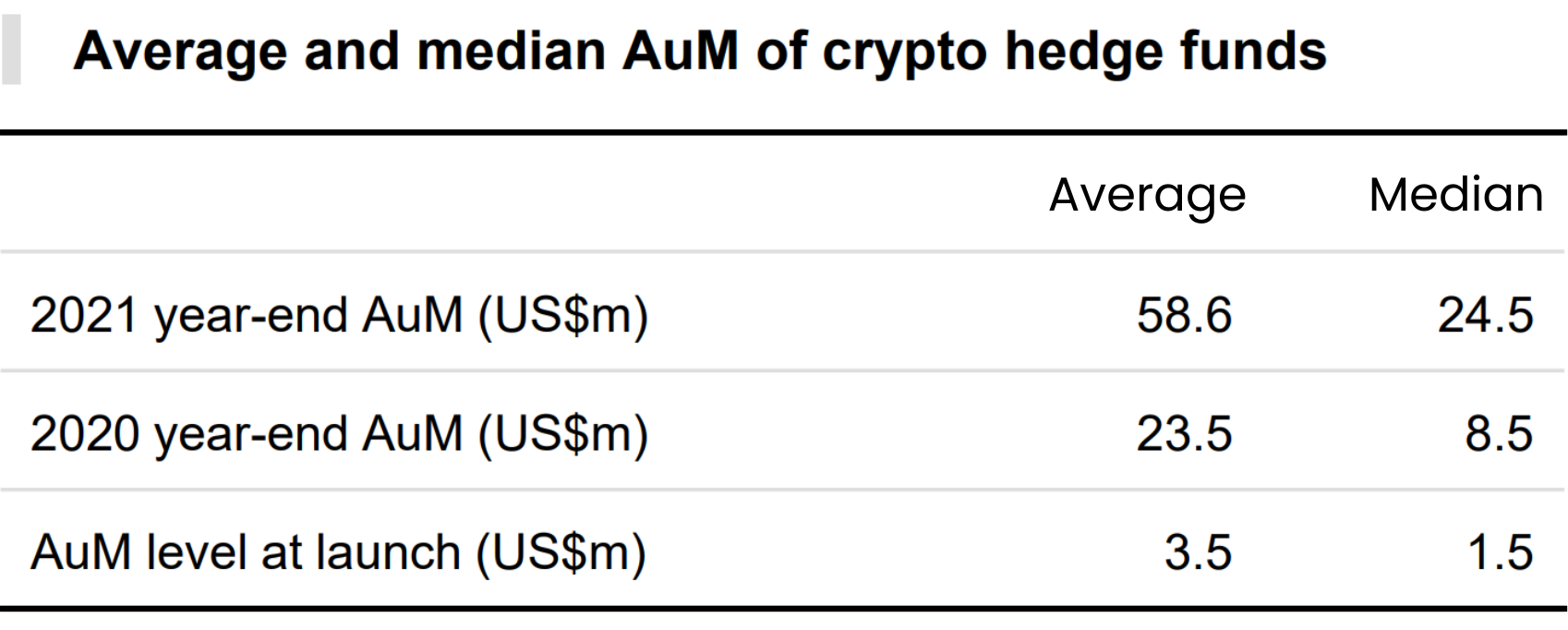

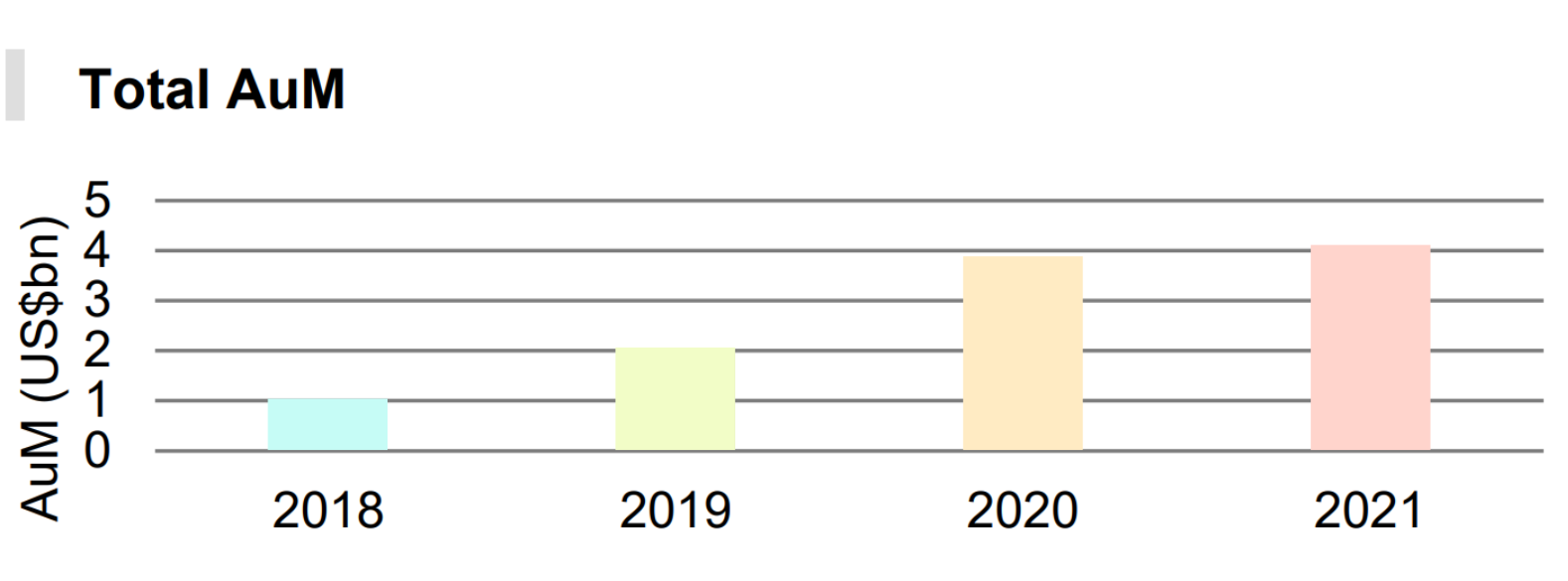

Source: PWC 4th Annual Global Crypto Hedge Fund Report 2022

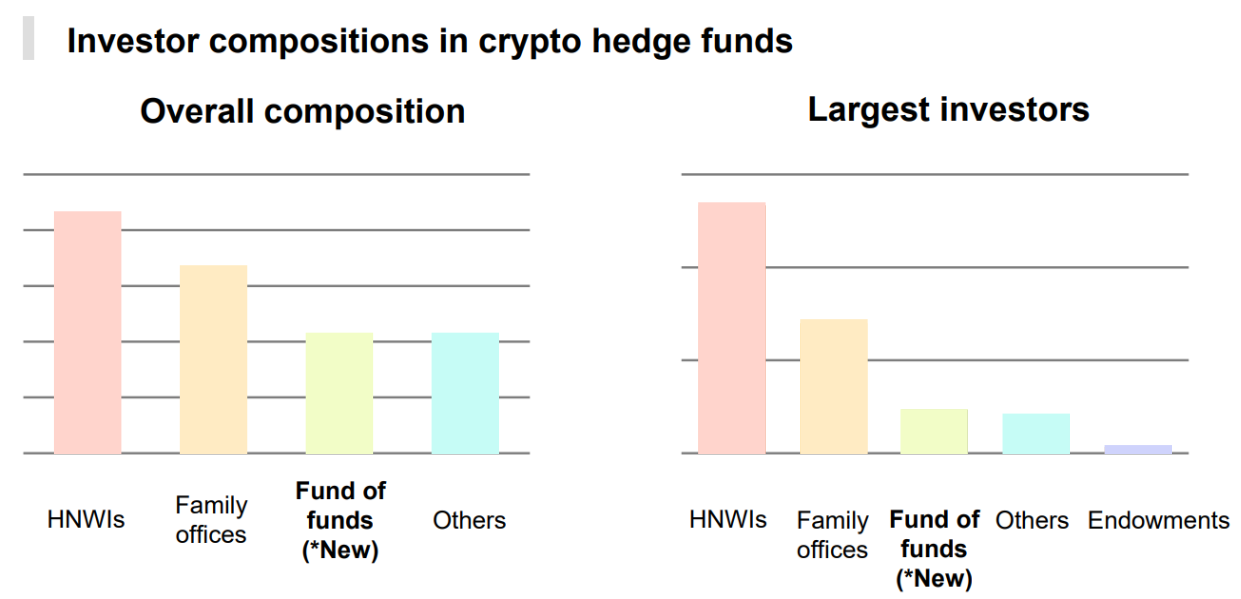

With cryptocurrency being a popular sector for a lot of investors, clients are seeking exposure in the area. Because evaluating tokens requires vast knowledge of the cryptocurrency industry, the easiest way for RIAs to get exposure to digital assets is through private funds. HNW individuals are the most common investors in crypto hedge funds, and RIAs will need to be able to serve these clients by enabling access. According to the PWC Crypto Hedge Fund Report, the AUM, exposure, and size of crypto funds continues to grow at a record pace.

Source: PWC 4th Annual Global Crypto Hedge Fund Report 2022

Source: PWC 4th Annual Global Crypto Hedge Fund Report 2022

Crypto funds during market downturns

Amid market turmoil, crypto funds are still seeing extreme demand. a16z’s most recent crypto fund completed a $4.5B raise in May 2022. A fundraise of this size signals the institutional market’s faith in digital assets, and the private fund market’s ability to service that demand.

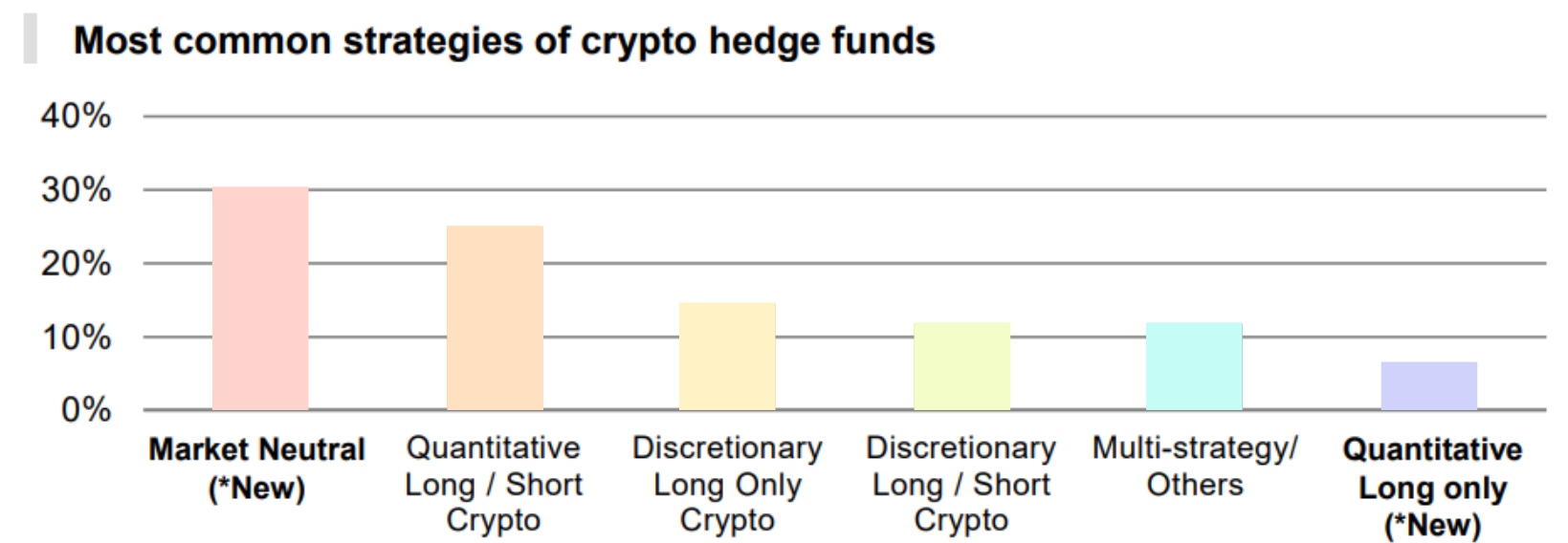

In the 4th Annual Global Crypto Hedge Fund Report, the most common crypto hedge fund strategy is market-neutral, followed by quantitative long/short. This demand for neutral-positioned funds represent a clear trend during crypto bear markets. This allows institutions to have the exposure they want in crypto, with less risk.

Source: PWC 4th Annual Global Crypto Hedge Fund Report 2022