Marketplace, Diligence, & Data

Marketplaces

The purpose of a marketplace ecosystem is to provide access, increase efficiency, improve transparency, and facilitate communication between users. The necessity of a marketplace for private funds can be compared to platforms such as Airbnb or Zillow. These marketplaces have a common fundamental goal; to bring together interested parties that seek to benefit from one another. Marketplaces are able to provide crucial elements such as access and exposure at scale to streamline efficiency between users. A marketplace that serves private funds allows investors and managing partners to equally benefit from the elements that a marketplace provides.

Traditionally, the vast majority of private fund deals are sourced via events, referrals, or response to cold outreach. This means allocators are spending thousands of dollars per fund and multiple hours per pitch. Overall this limits the allocation efficiency and effectiveness. By implementing technology that a marketplace has to offer, the process for allocating into funds can be automated. Fund managers would have access to exposure while standardizing reporting metrics that will make investments in private funds easier.

Diligence is the majority of man-hours for any institutional allocator

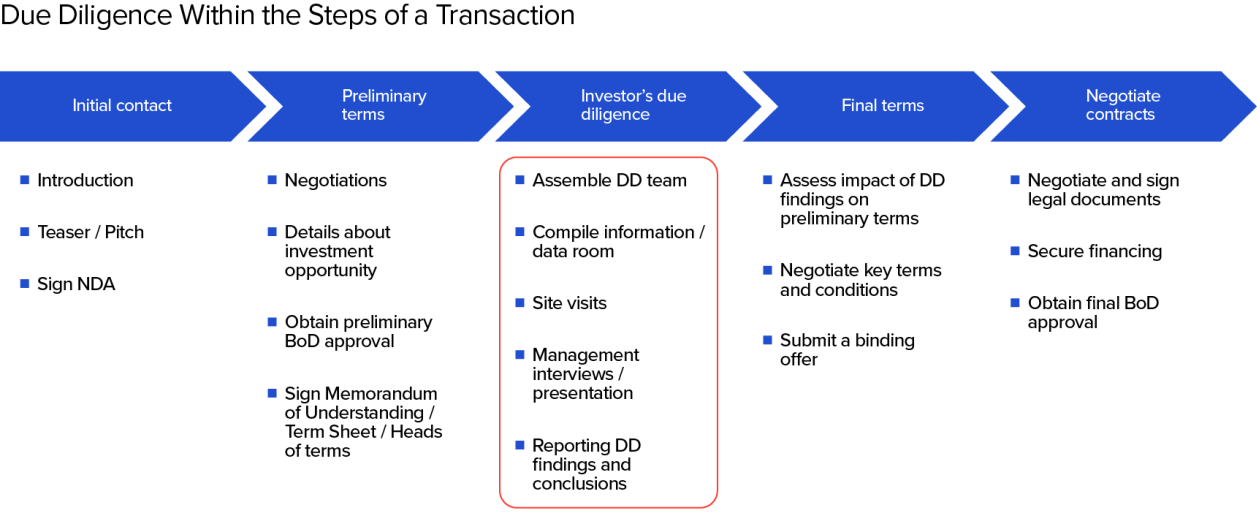

When making an investment decision, institutional allocators dedicate valuable time and resources analyzing private funds that often lack basic information. In turn, this is costing allocators money while wasting their specialized judgment, experience, and expertise. Allocators are consistently looking for ways to efficiently source and evaluate helpful information to aid in their diligence processes. By automating the diligence processes, this will allow allocators to reduce their time to make an allocation, saving thousands in annual costs.

The power of transparency

Increased transparency in alternative investments is key in the democratization of private finance. The lack of transparency in alternative investments is notoriously the biggest hurdle investors and managers face. However, transparency provides a symbiotic relationship to both investors and asset managers. Asset managers that have access to extensive information have an advantage when it comes to negotiating promising deals in private markets that ultimately deliver higher returns. In a study conducted by eFront based on 1,800 active alternative investment funds, the funds that provided the most transparency to their LPs were found to be the best performing.